Only $300 + state fee

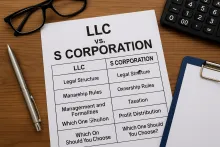

LLC vs. S Corporation: Key Differences Every Business Owner Should Know

When starting a business in the United States, entrepreneurs often face a critical choice in selecting the right business structure. Two of the most popular options are the Limited Liability Company (LLC) and the S Corporation (S Corp). While both offer liability protection and certain tax benefits, they differ significantly in structure, taxation, and management. Understanding these differences can help you choose the right path for your business.