"Dispute Resolution Strategies for LLCs: Best Practices for 2025"

As the business landscape evolves, effective dispute resolution strategies become increasingly essential for Limited Liability Companies (LLCs) in 2025. This article outlines best practices that LLCs can adopt to minimize conflicts and resolve disputes in an efficient manner.

Business for Foreigners in the USA: How to Open and Run a Company Remotely

The United States remains one of the most attractive destinations for entrepreneurs worldwide. Even without living in the U.S., foreign nationals can start and manage a company — often 100% remotely. This opens access to the U.S. market, payment processors like Stripe and PayPal, and international credibility. However, the process involves specific legal, tax, and logistical steps.

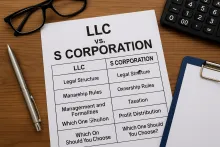

LLC vs. S Corporation: Key Differences Every Business Owner Should Know

When starting a business in the United States, entrepreneurs often face a critical choice in selecting the right business structure. Two of the most popular options are the Limited Liability Company (LLC) and the S Corporation (S Corp). While both offer liability protection and certain tax benefits, they differ significantly in structure, taxation, and management. Understanding these differences can help you choose the right path for your business.

The Hidden Challenges of Opening an LLC in the United States

Starting a Limited Liability Company (LLC) in the United States is often marketed as a simple, flexible, and low-cost way to launch a business. With online services and state filing portals making the process appear seamless, it's easy to assume that forming an LLC is as straightforward as filling out a form and paying a fee. However, many entrepreneurs—especially non-residents and first-time business owners—encounter a range of unexpected challenges. From bureaucratic red tape to banking hurdles, the road to establishing an LLC can be more complicated than it seems.